Renewable energy and new technologies that are making low-carbon power more reliable are growing rapidly in the U.S. Renewables are so cheap in some parts of the country that they're undercutting the price of older sources of electricity such as nuclear power.

The impact has been significant on the nuclear industry, and a growing number of unprofitable reactors are shutting down.

When the first nuclear power plants went online 60 years ago, nuclear energy seemed like the next big thing.

In many ways, it lived up to that promise. It turned out to be remarkably safe and reliable and clean. It's carbon-free and is the source of about 20 percent of the country's electricity.

But right from the start, people in the nuclear industry struggled with a big problem: cost. Making nuclear power cheap was the Holy Grail.

It never panned out. Nuclear plants keep coming in over-budget. And after the Fukushima disaster in Japan in 2011 — when three nuclear reactors melted down after an earthquake and tsunami hit — companies were forced to spend millions of dollars more on safety equipment to keep older plants operating.

"It would be very difficult for any company to make a decision to try to build a new nuclear plant," says Mike Twomey, a spokesman for Entergy Nuclear, which runs nuclear power plants.

Entergy has already taken one unprofitable reactor offline in Vermont and plans to close two more plants that are losing money in upstate New York and Massachusetts.

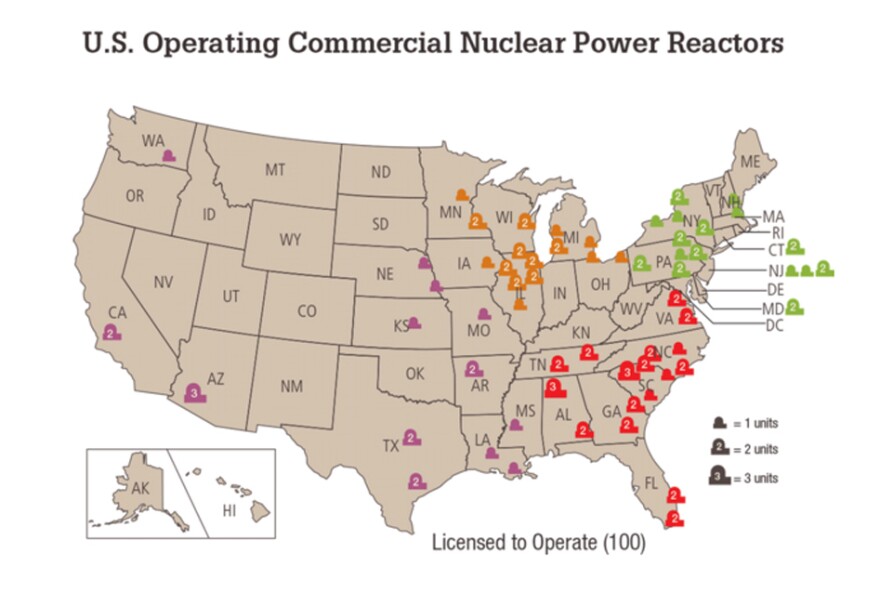

In all, 19 nuclear reactors are undergoing decommissioning, of which five have been shut down in the past decade, according to the U.S. Nuclear Regulatory Commission.

The main reason behind the wave of closures is a new generation of cheap, gas-fired power plants that has pushed the wholesale price of electricity into the basement.

But Mycle Schneider, a nuclear industry analyst, says nuclear also faces growing price pressure from wind and solar. Renewable energy is so cheap in some parts of the U.S. that it's even undercutting coal and natural gas.

"We are seeing really a radical shift in the competitive markets which leave nuclear power pretty much out in the rain," Schneider says.

Over the past decade, no new nuclear power plants have begun commercial operations in the U.S.; the last reactor to start up in the U.S. was in Tennessee in 1996 (another unit at the same plant is expected to come online sometime later this year).

There are a handful of new nuclear reactors under construction in the South, where energy markets are still highly regulated. Big power authorities there don't face the kind of head-to-head competition that has revolutionized energy markets in other parts of the country.

But even within the nuclear industry itself, a growing number of experts agree that the U.S. has reached a pivot point, where new nuclear power plants are just too expensive.

"We think that the costs of new nuclear right now are not competitive with other zero-carbon technologies, renewables and storage that we see in the marketplace," says Joe Dominguez, executive vice president for governmental and regulatory affairs and public policy at Exelon, a nuclear power company that has announced plans to close one of its existing reactors in New Jersey.

Three other plants that are losing money in Illinois and upstate New York are also being reviewed for possible closure, Dominguez says.

"Right now we just don't have any plans on the board to build any new reactors," he says.

Companies like Exelon and Entergy hope state governments will agree to subsidize their existing reactors, paying a premium for low-carbon nuclear power in the same way they now subsidize wind and solar.

The companies say the steady power generated by nuclear still pays an important role stabilizing the nation's energy grid.

But America's reactors are aging. The average is now 35 years old. With the new investment going to natural gas and increasingly to wind and solar, the old energy of the future may soon be eclipsed by the new energy of the future.

Copyright 2021 NCPR. To see more, visit NCPR. 9(MDAxODg3MTg0MDEyMTg2NTY3OTI5YTI3ZA004))